About Us

Who We Are

Blue-Ocean Capital Holdings and parent company I-deal Homes Real Estate Holdings, LLC, were founded in 2012 by CEO Mike Corica, along with his wife and COO, Lorie Corica. The team’s focus has always been to provide high quality real estate investing opportunities with strong returns for their investor partners.

The company has grown from investing mainly in residential fix and flips to multi-family apartment buildings as their primary focus. With their extensive real estate investing experience dating back to 2012, Mike and Lorie have repositioned $100 million in assets, and have been involved in hundreds of real estate transactions.

Mike and Lorie have successfully repositioned several apartment buildings in Arizona, Mississippi and Oklahoma, and have recently entered the Cleveland market, where they are currently repositioning their latest asset.

Our Combined Experience

Blue-Ocean Capital Holdings and our Co-Sponsor, Freeland Ventures currently own more than 3,000+ units of apartments. Freeland Ventures has also managed its own diversified high-yield debt funds since 2015, which included underwriting, originating, structuring, and funding more than 450+ residential and commercial private loans and equity investments for other investors and real estate entrepreneurs nationwide.

Our Core Business Strategy

The core business strategy for Blue-Ocean Capital Holdings is to identify off-market, undervalued, value-add, Class B apartment buildings to invest in and owner/operate. Purchasing and operating these secured physical assets, we underwrite conservative high-yield private investor equity investments and private money loans alongside 1st mortgage senior debt from bridge lenders and agency lenders like Fannie Mae and Freddie Mac. This creates stable, strong secured returns for passive investors.

Meet Our Team

Lorie Corica

After a long and fulfilling career as a primary school teacher, Lorie Corica began her full time adventure in real estate. Her love of design and construction pulled her into the exciting and ever changing world of real estate. Lorie and her husband Mike founded a fix and flip company based out of San Diego, CA. Lorie’s primary focus was project management, and to oversee the renovation and design of the hundreds of fix and flips the company did over the years. She and Mike then added multiple vacation rentals to their portfolio in San Diego, as well as many single family rentals in Florida. In 2017, they began to add the multifamily component to their assets. Lorie applied her skills to the underperforming apartments they acquired, and she and Mike transformed them into performing assets. They have successfully repositioned several apartment buildings in Arizona, Mississippi and Oklahoma. Lorie’s focus today is to shift her attention full time from her fix and flip business to building partnerships and passive income through cash flowing apartments, with a goal of 1000 doors in the next three years.

Mike Corica

Mike has been investing in real estate since the early 2000’s, when he began his real estate journey as a residential agent. He soon realized his superpower was recognizing opportunities while also having the vision to execute what is needed to reposition assets to their full potential.

Mike enjoys the hunt for value-add assets and thrives on building win-win opportunities for his investors, while at the same time nurturing strong agent relationships.

Mike oversees a sales and management team of six, who help him with the underwriting and acquisition process, thus prioritizing opportunities.

Mike also enjoys managing investor relations and has recently recruited approximately $5M in private capital. Additionally, he has built strong relationships with JV partners to take down assets in the 50M range.

Our Advisors

Our senior advisors have spent years acquiring, funding, repositioning, and managing diverse real estate assets and investments. Together, these investments represent a combined portfolio of over 3,000+ units of apartments valued at $225,000,000 and growing.

Josh Cantwell – Senior Advisor

Chief Executive Officer,

Freeland Ventures

manages over $40M in private money, which is deployed into multifamily real estate and apartments. He has been involved in 1,000+ wholesale, rehab, rental, foreclosure, and apartment transactions, and currently holds a portfolio of over 3,000+ cash-flowing apartments. He is the founder and CEO of a variety of successful businesses including Freeland Ventures and Strategic Real Estate Coach.

Glenn Lytle – Senior Advisor

Chief Strategy Officer,

Freeland Ventures

has been investing in real estate for over 15 years and co-founded Freeland Ventures with Josh Cantwell in 2015 as a partner to manage investor relations and help drive private equity investments. He has ownership in over 3,000 rental units and also manages over $34M in private investments, which has funded over 350 fix and flip, rental and small balance commercial deals during that period. In addition to real estate and capital management, Glenn has held executive leadership roles in some of the largest, fastest growing telecommunications companies in the US. and has built and rebuilt multiple sales and operations teams and organizations in various regions and industries.

Tyler Brummett – Senior Advisor

COO/ President of Asset Management,

Freeland Ventures

is responsible for scaling Freeland’s real estate portfolio and overseeing budgets, expenditures, and property management. He is also responsible for sourcing, reviewing and negotiating all of the real estate opportunities, and is the primary contact for acquisitions and possible joint venture opportunities. He brings 9 years of sales and lending experience in residential, commercial, and private equity, 6+ years running his own real estate investment companies, and 7+ years being a director for the nation’s largest mortgage lender. In 2019, Tyler was nominated by Crain’s Cleveland Business “Twenty in their 20’s” as a rising star of top professionals in Cleveland.

Decades of Investing

Having been investing since 2001, we have operated through multiple market cycles. We are real estate investors and operators using technology to provide unwavering due diligence and investment opportunities. Investors can benefit from our “boots on the ground” market research, information, and investing techniques.

Freeland Ventures provides investment opportunities and a wide array of options, with these potential benefits:

- Asset Diversification

- Ordinary Income

- Appreciation and Capital Gain Income

- Depreciation Tax Benefits

- Equity and Partnership Opportunities

- ADebt Investments: Notes and Mortgages

- Diversified Fund Investments

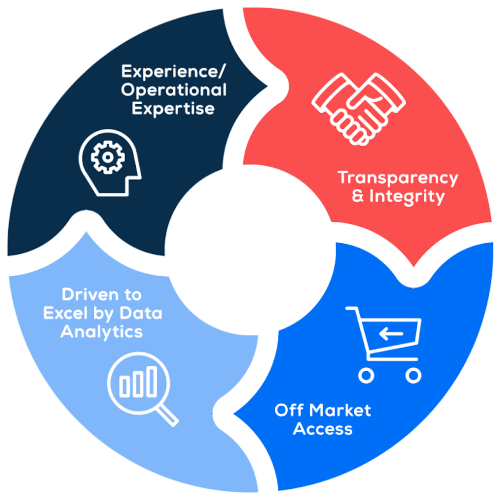

The Blue-Ocean Capital Holdings Difference

Blue-Ocean Capital Holdings believes in selecting the best properties to invest in. This starts with disciplined underwriting and due diligence on the multi-family asset. We select properties with high occupancy that are undervalued. We create a custom value-add business plan for each asset. Then, we force appreciation through value-add execution, adding amenities, and increasing revenues. We also select JV partners and Co-Sponsors who are successful, competent, hard-working, and enthusiastic investors who truly know and understand our business model.

We apply our “value-add/value investing” approach to every deal we own/operate, invest in, or fund. We take this responsibility very seriously. Our executive team understands market cycles, that real estate is extremely “local,” and that each market is different.

Our focus is on buying, owner/operating, and funding undervalued assets with reposition “value-add” opportunities and strong income potential.

Our Co-Sponsors integrated vertical business model allows us to buy the asset in a special purpose entity, handle the improvements through Freeland Construction, manage the building through 950 Management and keep investors updated through Freeland Capital Management, all working together to create a seamless business model.

Core Values

- We provide strong, reliable, and consistent passive investment opportunities for all our investors.

- We provide tenants with clean, quality, upgraded, affordable housing that feels like home.

- We provide a fun, happy, healthy environment for staff and team members who are focused on getting results for tenants, passive investors, and shareholders.

Core Competencies

Blue-Ocean Capital Holdings and our Co-Sponsor,

Freeland Ventures has acquired, renovated, manages,

and holds more than 3,000+ apartment units—valued

at over $225,000,000. Our business model allows us

to oversee all asset and project management,

ensuring a consistent, value-oriented approach that

drives success.

By bringing together extensive market research and

proprietary data, I-deal Homes is best positioned to

analyze market cycles and anticipate trends in any

market. We follow a thorough and data-driven

approach for each investment, and always aim to

deliver low-risk, high-return opportunities.

Blue-Ocean Capital Holdings seeks to develop

investment partnerships anchored in trust,

transparency, and a clear-cut alignment of interests.

It’s a simple framework that encompasses every

conversation, every communication, and every

investment opportunity.

Blue-Ocean Capital Holdings and our Co-Sponsor,

Freeland Ventures has acquired, renovated, manages,

and holds more than 3,000+ apartment units—valued

at over $225,000,000. Our business model allows us

to oversee all asset and project management,

ensuring a consistent, value-oriented approach that

drives success.

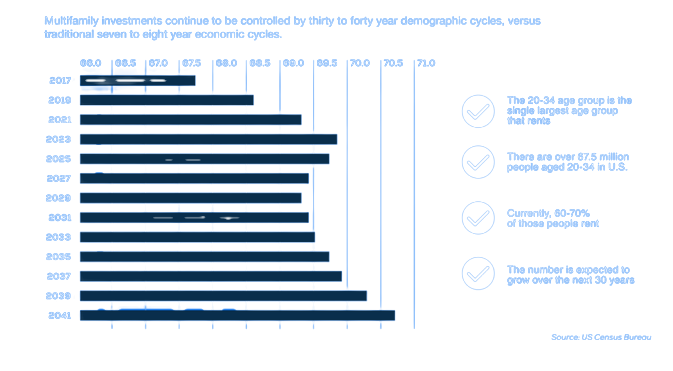

Multifamily Real Estate In Today’s Market

The 2008 recession pushed more and more Americans away from traditional homeownership and, today, the effects are still being felt, especially on the millennial market. In short, there is always—and will always be—a large demand for well-priced rentals in key markets.

Blue-Ocean Capital Holdings and our investors are focused on leveraging targeted opportunities within the multifamily sector. By acquiring strategic properties, our organization

Renters at Every Age & Stage

Seeking to downsize, early-stage Boomers are scooping up leases, with many looking to shorter-term temporary rentals in cities, college towns, and vacation hotspots. On the other end of the spectrum, millennials are in search of long-term rentals which better enable them to set down roots and start families in choice communities. Neither necessarily wants to buy—many adopt a “try-before-you-buy” approach or, simply, don’t have the resources to make a home purchase. But at the same time, both want to define “home” on their terms. At the moment, that means a quality rental.

Trending Rentals

Multifamily investments continue to be controlled by thirty to forty year demographic cycles, versus

traditional seven to eight year economic cycles.

Project/Transactional Life Cycle

Whether you’re coming to Blue-Ocean Capital Holdings as a passive investor, buyer, seller, or real estate

broker/agent, you’ll want to know how we run our business and the properties we buy, owner/operate, and invest

in. It’s important to us to show transparency, integrity, and accountability as part of our core values. To keep our

reputation as Ohio’s leading real estate investment solutions company, we need to follow strict purchasing

criteria. Here’s your opportunity to look “under the hood” at our criteria.

Step 1

Property Discovery & Acquisition

Once we’ve identified potential opportunities, our expert team filters based on key factors—including price, location and asset quality. This process ensures we only acquire investment properties that meet our goals and expectations, and that will pass the stringent underwriting process that follows.

Step 2

Underwriting & Funding

The initial underwriting process kicks off with our comprehensive 53-step extensive due diligence schedule that taps into our extensive structuring expertise. From onsite inspections to a financial deep dive to mitigating potential risks while maximizing rewards, we dig deep on each potential deal, with only the most qualified moving forward to be approved for funding and purchase.

Step 3

Renovations, Property Development & Ongoing Value Add

Freeland Ventures focuses on renovating each investment property. To build value, our team is able to refresh or overhaul underperforming assets, which would drive up rents and increase interest. This immediately improves cash flow and long-term capital appreciation, while limiting ongoing maintenance expenses. This creates a more valuable asset for all parties.

Our partners and investors receive quarterly updates during the renovation process. Between these check-ins, our team is also available via phone or email as needed.

Step 4

Stabilizing & Refinancing Assets

Once the property is stabilized for 90 days, we refinance the property with long-term financing at a fixed interest rate. At that time, we pay back the acquisition loan and equity investors in full. With long-term debt in place, investors maintain equity in perpetuity and receive quarterly cash flow distributions and property financial statements.

Step 5

Managing & Operating Structured Assets

Team Overview

Blue-Ocean Capital Holdings: Mike and Lorie Corica

Advisors: Josh Cantwell and Jason Yarusi

Residential and Commercial experience:

- Flipped approx. 200 houses, supervised multiple 6 &7 figure Cap Ex renovations and property management teams

- Ownership of multiple apartment assets, along with large SFR, STR portfolio

- Mike and Lorie have successfully repositioned six multifamily assets

Contact info:

Lorie Corica

760-578-3988

lorie@blue-oceancapitalholdings.com